By Bakar Ceesay

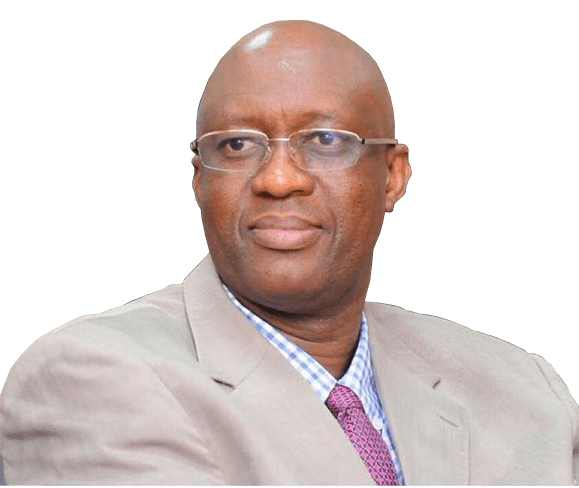

Authoritative sources has disclosed that the Commissioner General Gambia Revenue Authority (GRA) Mr. Yankuba Darboe alongside with the Director of policy and planning at the Gambia Revenue Authority Mr. Yahya Manneh, and other top Government representatives from the Ministry of Finance and Economic `Affairs, (MOFEA) and Central Bank of The Gambia are currently in Boston United States of America (USA) on government function.

The top prominent Gambian experts left Banjul International Airport last weekend, to (USA) in a bid to attend special designed comparative tax policy and Administration program at Harvard University which is one of the best Universities in the World.

In a chart conversation with the commissioner General, Mr. Yankuba Darboe confirmed that yes, “We are there in Boston (USA) to attend a special designing comparative Tax policy and Administration program at Harvard University”. He expressed profound gratitude to be associated with this program, for the fact that Harvard University is one of the best Universities in the World, therefore attending a program there is a love of everyone. CG Darboe stated.

He also assured that any knowledge gain at the program will be fully share with the staff and management of (GRA) for prosperity purpose.

In a related development shortly before his departure, CG Darboe spoke extensively on the essence of digital transformation reforms , saying that with the advent of digitalisation reforms , it has greatly yielded dividend and the impacts has reflected in the revenue collection performance.

CG Darboe further strongly attributed (GRA) success to the latest migration of digitalization reform to the ASYCUDA –World.

According to him (GRA) collected closed to (D1.6Billion) in a single month of July and has currently collected (62%) of its annual revenue target, due to the digitalization reforms which has a positive impact on the revenue collection performance.

Mr. Darboe further stated that (GRA) was able to register this unprecedented revenue performance on monthly basis due to the latest technologies and innovation that GRA introduced.

He further dilated on wide range reforms that contributed a lot in helping (GRA) “what is collecting today” in term of revenue.

He said those reforms include level of tax compliance from the business companies particularly the telecom companies, oil marketing companies just to name a few.

Mr. Darboe emphasised that the digitalization of their operation in revenue collection is helping (GRA) to increase the revenue collection performance.

Mr. Darboe described the transformation of (GRA) from analogue to digitalization was long overdue for the fact that (GRA) is now recording high revenue performance on monthly basis compared in the past.

According to CG Darboe in realising this steadfastness revenue performance, (GRA) embraced the migration to digitalization reforms which is very helpful in the revenue collection.

CG Darboe further dilated extensively on staff motivation which he said is among his top priority at the level of (GRA). He also stated that capacity building of his staff is key in (GRA) strategic planning. Also continue tax payer’s education through radios, newspapers, television and seminars also help a lot in terms of tax payer’s compliance.

Mr. Darboe further extoled its line ministry of finance and Economy affairs for the support which is very important towards the success of (GRA).

According to GRA Boss Mr. Darboe “if the level of tax compliance continues to increase” (GRA is optimistic of achieving the (D15.208 Billion) annual revenue target for 2023

Commenting on the area of senior staff retired at (GRA), Mr. Darboe stated that retire is a fact of life, but in (GRA) “we have what we called succession planning”. “All the departments are following the successful planning”. “This is what helps up to continue progressing despite some of our good staff gone on retirement”. “For the future, as far as revenue collection is concern “we are confident that we will do better inshallah due to our continue reforms on digitalization”.