With Mariama K Bojang

Life is wrought with uncertainties and challenges. The only thing constant in it is change. Whether it’s a good change or a bad change, you never really know. That is why it’s essential to prepare for these events in the best way you can. The insurance that we, at Prime Insurance company, offer will help you do all of that and more.

Insurance provides you the sense of both safety and security in your business and personal lives.

The Voice Newspaper introduces a new column THE INSURANCE BRIEF. This column will be looking at car insurance in case of vehicular related incidents, home insurance in case of extensive damage to homes and buildings, business insurance in case of any business risks and threats, health insurance in case of any illness that may befall you or your family, life insurance in case of any death in the family, dental insurance in case of any dental care needs, vision insurance in case of any eye care needs and disability income insurance in case of any injury that incapacitates you and prevents you from working

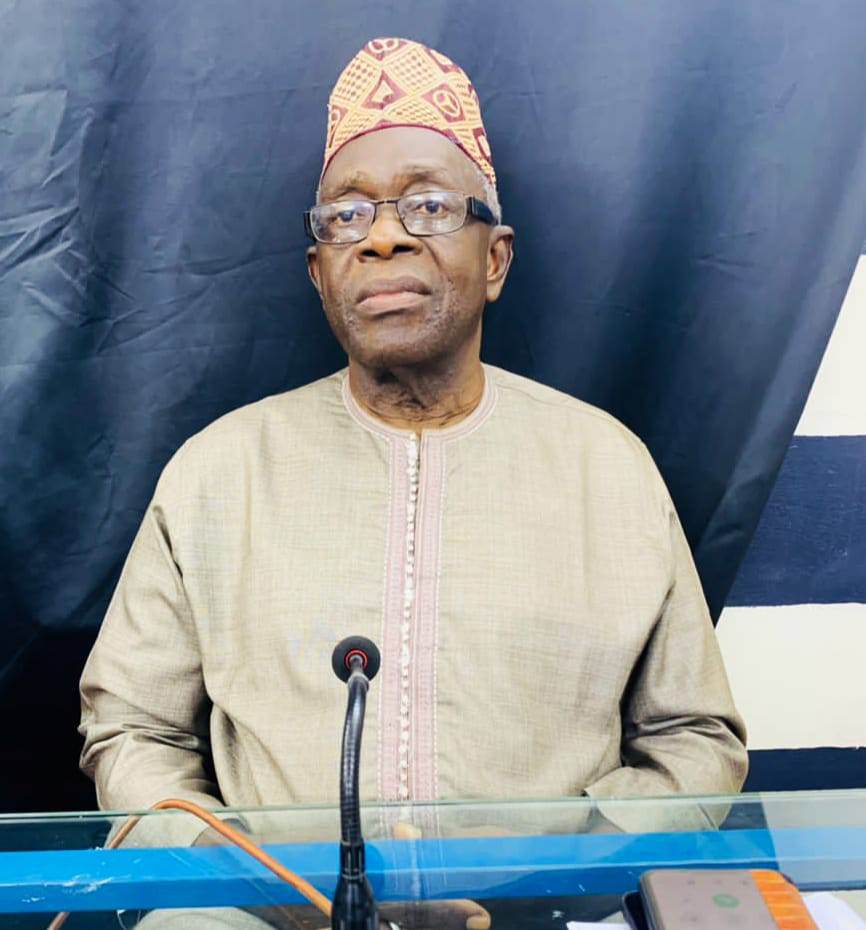

In this first edition, INSURANCE BRIEF chats with Ebrima Nyass, head of Prime Insurance Company Serrekunda branch, talked about his company establishment, vision, mission core values, etc.

Prime Insurance was incorporated on 14th of February 1997. The company was licensed on the 26th of May 1997 and commenced business on 1st July 1997, life insurance business. Formal certificate of re-registration has been granted by Central Bank of the Gambia to continue as an insurer having satisfied all relevant requirements under the insurance Act, 2003.

He disclosed that the authorized share capital of the company is D30 millions, while D22.9 million is fully paid up and deposited with the Central Bank of The Gambia.

Nyass also said the company affirms its position as one of the most capitalized insurance companies in The Gambia.

The company’s strategic focus, as a comprehensive one stop financial institution in General Insurance business, has enable it to achieve a balanced and sustained growth, borne largely out of the ability to win and retain market share through innovative, courteous and efficient service delivery.

Vision

To be a role model for Gambian Businesses through the consistent achievement of superior returns for our numerous stakeholders.

Mission

To build an efficient insurance institution anchored on professionalism with commitment to integrity, empathy, prudence and an uncompromising quality in service delivery.

Our Core Values

Integrity_ Uphold the virtues of moral excellence, honesty, truthfulness and sincerity in all interactions with customers and other stakeholders.

Resilience– Ability and character to bounce back from setbacks to succeed against all odds and challenges.

Empathy– knowledge of the customer and intimate understanding of client concerns for enduring relationships.

Humility-Appreciation and respect for clients and other business associates.

The company’s commitment to excellence has facilitated the efficient delivery of quality products to the satisfaction of our numerous clients. We have assembled a team of seasoned professionals who bring our superior after sale service to your doorstep.

We provide protection under the following classes, fire and Allied Perils, theft/Burglary, All Risk, Money Insurance, Goods In Transit, Fidelity Guarantee, Marine Cargo\Hull, Electronic Equipment Insurance, Group Personal Accident Insurance, Workmen’s Compensation/Employers liability insurance, Bonds (tender/Advance/Performance), Contractors’ and Erection All-risks, Aviation insurance, Public and Product Liability, Motor Insurance, Machinery Breakdown Policy, Travels personal Insurance, Professional Indemnity Insurance, Travel Health Insurance(in partnership with Reise-Schutz AG of Germany) for visitors to Europe (including the Schengen States).

Fire and Allied Perils:

This provides cover for your building or the contents of your office complex or private dwelling house against the risk of physical damage or restructures resulting from fire, lightening or limited explosion and other named perils such as malicious damage, windstorm, impact, flood, riots, strikes and civil commotion.

BURGLARY:

Contents of a building for business or a private dwelling house could be insured against theft through violent and forcible means. Indemnity or compensation is based on valuable insured items that are susceptible to theft and evidence of a burglary incident where entry into the premises was through violent and forcible means.

EMPLOYER’S LIABILITY:

The injuries compensation Act 1990 imposes strict liability on injuries without proof of negligence if an employee should suffer whilst on duty. We can handle this potential liability if you take out an employer’s liability insurance which covers any employee in the insured’s services for accidental death, bodily injury or disease sustained in the course of or arising out of this employment and payable under the workmen’s Compensation Act or at Common Law.

PUBLIC LIABILITY:

Individual or Organisations alike are under an obligation by law to regulate life and activity in such a manner to avoid causing harm to other person or their property. If he fails in lawful duty to others, the injured party is entitled to compensation in the form of damages.

What our public liability policy does is to offer compensation or indemnity to our insured’s against their legal liability to third parties example (customers, visitor) in respect of property damage, accidental death and or bodily injuries sustained whilst at the insured’s premises.

GROUP PERSONAL ACCIDENT

This insurance covers your staff for injuries they may sustain at work or after work during the full 24 hours of the day. The geographical scope of the cover is world – wide. The benefit payable may be arrange as a multiple of the basic salary of each employee or as a fixed sum.

MACHINERY BREAKDOWN:

The policy covers your machine against any unforeseen and sudden physical loss or damage from causes such as defects in casting material, faulty design, faults at workshop or in erection, physical explosion, tearing apart on account of centrifugal force, short – circuit storm or from any other cause not specifically excluded by the policy in a manner necessitating repair or replacement.

FIDELITY GUARANTEE:

The policy indemnifies you for financial losses due to the dishonesty of your employees, failure in the loyal performance of duty or in certain cases mistakes of another. The cover provided on this policy is for named employees or blanket cover, which is based on the amount handled by the employees.

CASH-IN-TRANSIT/SAFE:

The policy provides cover for case (ie currency notes, cheques, postal money orders, bank notes etc) whilst in direct transit from your premises to the bank or vice versa or from one of your premises to another within the country. It could also be extended to cover cash whilst on your premises during working hours.

ALL RISK INSURANCE:

This is the widest form of cover available for property as the name implies and covers accident physical loss, damage or destruction to property insured unless the policy specifically excludes or limits the coverage. It is the most popular form of cover available for valuables such as gold, jewelry, watches etc. Cover may be limited to a specific address but normally applies while the property is anywhere in The Gambia.

CONTRACTOR’S ALL RISK:

This type of offers comprehensive and adequate protection against loss or damage in respect of contract works, construction plant and equipment and/ or construction machinery, as well as third party claims in respect of property damage or bodily injury arising in connection with the execution of a civil engineering project. Indemnity to the principal and/ or employer for bad workmanship, defeats etc is usually by replacement, repair or repayment of the full cost of the damage.

TENDER BID BOND:

This type of bond guarantees a contractor and/ or supplier when bidding for a particular contract. The guarantor undertakes to pay the guaranteed amount to the employer if the tenderer (usually the contractor) decides to withdraw his tender bids before they are opened or if he fails to provide the employer with a satisfactory performance bond in accordance with the conditions of the contract awarded. The potential employer will ask for a guarantee (normal for 2% to 10%) of the contract price that if a contractor’s bid is accepted it will undertake the contract. If the contractor defaults and does not undertake the contact, a call is made on the Bond.

PERFORMANCE BOND:

Here both the contractor and guarantor undertake to pay the employer (i.e. the one giving out the contract) the amount guaranteed upon his demand without contestation. Usually the contractor provides collateral but where this is not available; he/she signs an indemnity agreement. This guarantee is provided to ensure maximum performance is below standard and the contractor is unable to rectify the defects, then the guarantor pays the full amount guaranteed to the employer and then demands a refund from the contractor through the indemnity he signed or the courts.

ADVANCE PAYMENT BOND:

This guarantees an advance given to a contractor to enable him start work on the project. The employer expects the advance giving out to complete works to a certain stage eg. Foundation or roof stage and the works must conform to the standard stipulated in the contract. When the contractor fails to complete works to the aspired level or delivers work that does not conform to the standards of the contract conditions and is unable to rectify or complete the works to the required stage, the guarantor pays the employer the full sum of the advance payment or employ somebody else to do the work.

It is important to note that liability under this guarantee is reduced in amount as and when the contractor submits certificates signed by the consultant or supervisor indicating that works have been completing to that stage as required by the terms and condition of the contract.

MARINE INSURANCE

CARGO

This section offers protection to the financial interest of the assured against accidental physical damage or loss to goods and or other interest whilst in transit. Cover provided can either be for goods shipped by sea or air. The goods should always be insured for full value to avoid the average condition ( i.e. claim settlement being proportionately reduced if sums insured are less than the full value of goods covered) at the time of loss.

HULL

This provides cover against perils that may result in the accidental physical damage or loss to the insured’s own vessel, or property. In addition personal accident cover for the captain and his crew and or passenger liability can also be provided.

AVIATION

This insurance covers accidental physical damage or loss to the insured’s aircraft whilst in flight, taxing or on the ground during maintenance check. Indemnity for insured’s legal liability towards third parties, passengers, cargo and or baggage is also available. Personal accident cover for pilots and cabin crew is provided together with spare parts cover for aircraft(s) if required. We also offer airport owners and operations liability cover.

MOTOR INSURANCE

We offer cover for comprehensive and third party benefits for vehicles of all categories.

Comprehensive benefits cover the vehicle for partial or total loss resulting from theft, fire or accident. It also covers third party death, bodily injury and property damage arising out of the use of the insured vehicle. This policy also covers medical expenses of the insured, his driver or any other occupant of the vehicle up to a reasonable amount including solicitor’s fees legal representation of the insured or his driver at any judicial proceeding arising from an accident.

Third party cover provides compensation for third party death, bodily injury and property damage. This policy does not cover the driver or his mate in respect of bodily injury and or death arising from the use of the insured vehicle. However, if the driver so wishes to be covered against death and or bodily, he can opt for a Personal Accident Insurance cover in addition to his Third Party Motor Insurance Policy.

TECHNICAL & REINSURANCE SUPPORT

Our company’s reinsurance programmes are arranged by United African Insurance Brokers (UAIB) a leading reinsurance brokering firm and African Reinsurance Corporation (Africa Re) is our lead Reinsurer.

For all your enquiries about insurance product and related services, please feel free to contact us at the following service points. Head Office Banjul, Serrekunda Branch, Barra Branch, Soma Branch, Basse Branch.

For Sponsor call 7079257