The Gambia taxpayers have been assured of an in-depth understanding of the Gambia revenue laws and the kinds of taxes administered by the Gambia Revenue Authority (GRA).

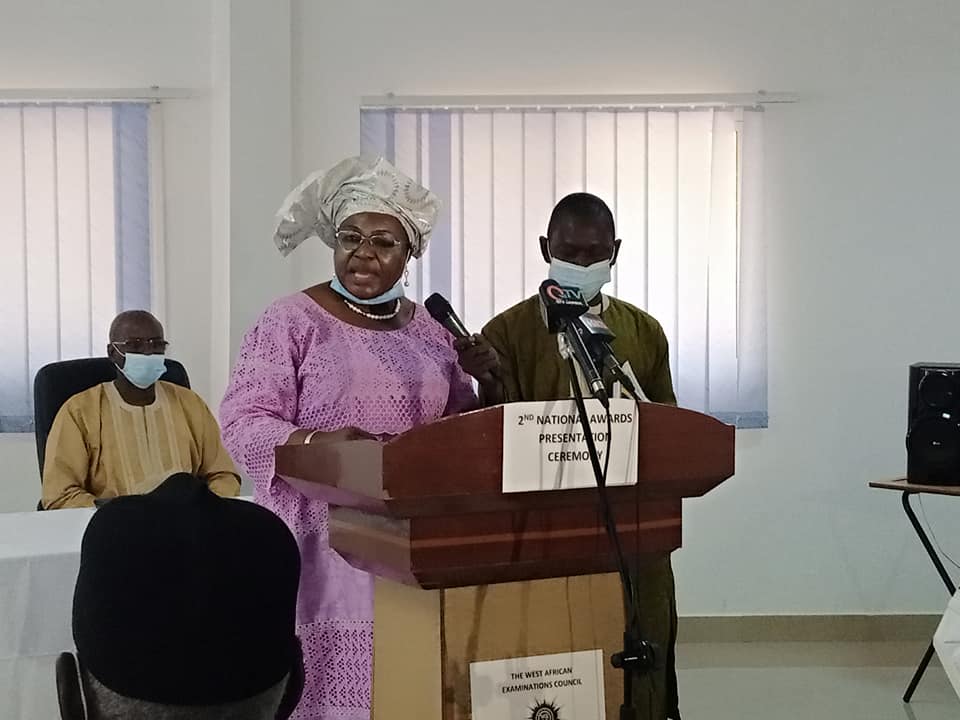

Delivering a speech on behalf of the Commissioner General at a recently concluded two-day taxpayers seminar for district authorities and business communities held recently in Mansakonko Lower River Region (LRR) John S. L. Gomez, the Director of Internal Audit at the Gambia Revenue Authority (GRA) said this would greatly help Gambia Revenue Authority (GRA) to perform extremely well in the collection of much-needed revenue for national development.

He noted that the more taxpayers understand their rights and obligations the more compliance that will result in more positive revenue performance for GRA.

Based on this fact, he said, the Gambia Revenue Authority (GRA) under the leadership of Commissioner General YankubaDarboe would not relent in its efforts to continue to spread its tentacles to further engage Taxpayers’ educations unit under GRA to enlighten the taxpayers more on the roles and mandates of GRA and the significance of Tax payment in National Development.

He reiterated that (GRA) under the visionary leadership of the Commissioner General would continue to place a high premium on educating and sensitizing them on revenue matters among other laws.

However, the regional taxpayer’s seminar convergence was organized by GRA and funded by the French Agency for Development.

The overall objective of the seminar was to sensitize and deepen participants’ understanding of their rights and obligations in the process of mobilizing revenue to support national development programs.

The GRA’s engagements with the District Authorities and business communities will be a continuous process to enhance efficiency and boost revenue collection.

However, the Authority launched the Automated Customs Data (ASYCUDA World) in June 2022, since its implementation, the system has significantly increased the Authority’s monthly revenue collection.

According to Gomez, the engagement was also part of GRA’s current corporate strategic plan for 2020 and corporate image. The deliberations by the facilitators were centered on the Gambian tax system, the accompanying revenue laws, the taxpayer’s obligations, and rights as well as the reforms initiatives implemented by the Authority to enhance efficiency in the revenue collection process.