Amet Ngallan / Fajara

In the news lately has been discussion about the GoTG proposed deal with Africa50, a subsidary of the African Development Bank, for the management of the Senegambia bridge.

Basically, the decision GoTG faces is whether to continue managing the bridge (including maintenance) – something they admit they are not equipped to do – and collecting the tolls, or let Africa50 manage the bridge on behalf of GoTG for 25-years and pay GoTG US$100 mil today for that right. Not much, if anything, has been reported about the fairness of the offer.

So, Africa50 has figured, from their standpoint, that US$100 mil is a fair estimate of the value today of 25-years of net cash flows from the bridge which they expect to collect. From the standpoint of Africa50, they are investing US$100 mil and expect a return on that investment. Gambia’s prespective is a bit different – they have basically no investment in the bridge, but only face having to figure out if US$100 mil is a fair price for handing over the bridge earnings to Africa50 for 25-years.

Back in November, 2011 The AfDB prepared an analysis of the costs and benefits of their funding the proposed Senegambia Bridge. Their report explains … “The total project cost of Phase I, including contributions from the two governments is UA 67.36 million. The project is co-financed by the Bank Group (99.07%), the Government of The Gambia (0.24%) and the Government of Senegal (0.69%)”. At the time, 1 UA = 1.11 Euro, so UA67.36 x 1.11 = 74.77 Mil Euro estimated bridge cost. Unfortunately, their analysis sometimes mentioned units of measure alternating between UA, Euros and US$, which adds to the confusion when trying to make sense of their numbers.

Regardless, GoTG faces having to justify that US$100 Mil is a fair amount for the net cash flows (receipts-expenses) the bridge project generates over the next 25-years.

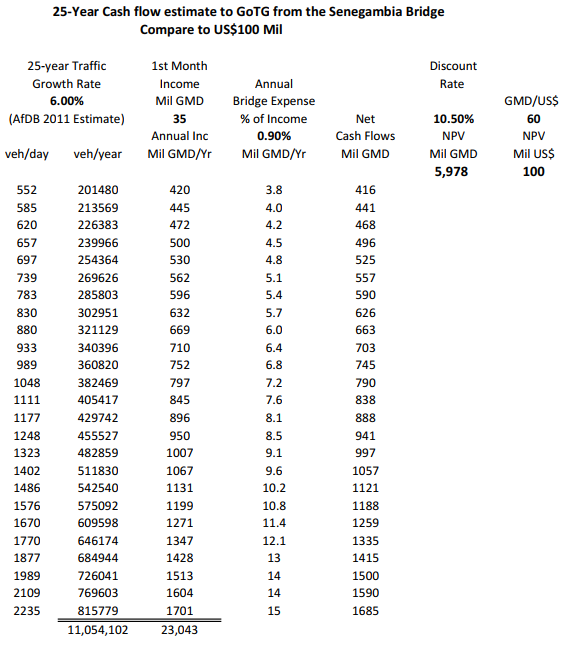

How to do that? It is usually done by estimating the value today of 25-years of net cash flows if GoTG manages the bridge itself, knowing there are plenty of variables and unknowns. Key numbers needed to figure the cash flows include an estimate of the starting traffic collections, an estimate of its hopeful rate of traffic growth over the years, an estimate of the cost of administering and maintaining the bridge every year, and what % to use to discount the cash flows. Financial types call this procedure a Net Present Value (NPV) calculation.

The 2011 AfDB analysis found the ferry in 2011 carried 552 vehicles/day. They estimated the traffic on the bridge traffic will increase at about 5%-6% per year. The Minister of Works & Infrastructure, Mr. Sillah, reportedly said the bridge is now collecting GMD30 Mil to GMD40 mil per month. So, if the bridge traffic grows by say 5% per year, it is reasonable to assume the receipts from that bridge traffic increases by at least the same amount (without fare increases). The AfDB estimated bridge upkeep costs at US$109,000/year, which at the time was about GMD 3.5 mil/year or roughly 1% of receipts during the first year. GoTG has only a small investment in this project, as does Senegal. As shareholders in Africa50, GoTG and Senegal expect to enjoy a small share of any profits in this venture.

So, using the only numbers readily available, the value of estimated cash flows to GoTG today is guessed at as shown here – what GoTG is giving up for US$100 mil. This is the procedure to use to judge if US$100 mil is a fair deal for GoTG – it is simply a starting point. The big issue with this estimate, of course, is what discount rate to use. The GoTG could invest their annual bridge proceeds in CBG TBills, now earning about 16%/year (very high), which could be used as the discount vale. One option would be a long term average of the TBill rate.

Those interested can use a spread sheet program to make their own guess-timates – a good exercise for UTG business students.

A similar analysis from the standpoint of Africa50 probably uses differ assumptions. We don’t know the values of the important variables they used their calculations. Over and out, The views expressed in this article are the author’s own and do not necessarily reflect The Voice’s editorial stance.