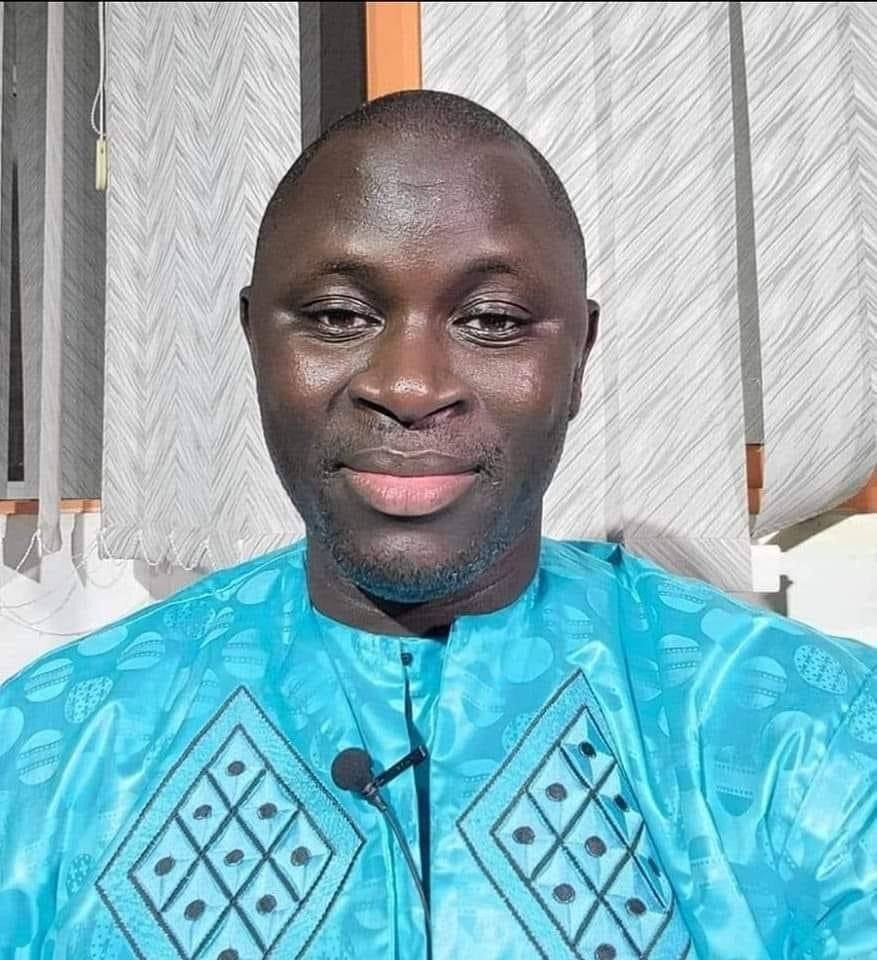

Hon. Buah Saidy, Governor Central Bank of The Gambia has said that the banking system remains safe and sound with stable financial soundness indicators, adding that the risk-weighted capital adequacy ratio stood at 24.4 percent in March 2023, higher than the regulatory requirement of 10 percent.

He said on Wednesday at Central Bank Monetary Policy Committee (MPC) briefing of commercial bank managers and journalists that the liquidity ratio stood at 44.6 percent, also above the prudential regulatory limit of 30 percent. The industry’s non-performing loan ratio remains low at 4.6 percent.

“Growth in monetary aggregates continues to decelerate consistent with the tightening of the monetary policy stance that started in 2022. Annual money supply growth slowed to 3.4 percent in March 2023, relative to 27.2 percent in the same period a year ago, owing to the contraction in the net foreign assets 5 of the banking system and a moderating net domestic asset as fiscal policy consolidates. Reserve money growth decelerated to 1.2 percent in March 2023, compared to a growth of 14.0 percent a year ago.

Preliminary data shows that balance of payments challenges remain. The current account deficit widened to 3.4 percent of GDP in the first quarter of 2023, from a deficit of 1.7 percent of GDP in the comparable period a year ago. The deficit in the goods account widened to 11.4 percent of GDP in the first quarter of 2023, from 7.8 percent of GDP in the first quarter of 2022, owing to higher import bills which more than offset the moderate growth in total exports,” he said.

According to him, the Bank’s gross international reserves stood at US$451.9 million as at end-April 2023, adequate to cover 4 months of prospective imports of goods and services. This coupled with stable remittance inflows is expected to help the domestic currency to remain stable in the near term.

He disclosed that in the foreign exchange market, volumes of transactions, which is an aggregate of sales and purchases of foreign currency, picked up by 12.8 percent (quarter-on-quarter) to US$644.1 million in the first three months of 2023.

He pointed out that the market continues to be demand-driven, mainly emanating from imports of food, telecommunications, construction materials, and energy, noting that on the other hand, supply benefited from official inflows from development partners, private remittances, recovery in tourism receipts and cross-border trade receipts.

Governor Saidy further disclosed that from January to March 2023, the dalasi remained relatively stable, depreciating slightly against the US dollar by 1.5 percent, Euro by 2.2 percent, and CFA franc by 1.1 percent but appreciating marginally against the British Pound by 0.2 percent.

He added that Government fiscal position improved in the reviewed period despite the challenging economic environment and the rising cost of borrowing. 4 Preliminary data indicated the budget deficit (including grants) contracted to D2.6 billion (2.5 percent of GDP) in the first quarter of 2023, from a deficit of D2.9 billion (2.7 percent of GDP) in the corresponding period in 2022.

“Total revenue and grants declined by 9.2 percent to D4.7 billion (4.5 percent of GDP), reflecting the drop in both grants and non-tax revenue. Total expenditure and net lending also decrease by 9.1 percent to stand at D7.3 billion (4.7 percent of GDP) in the first three months of 2023 compared to the same period in 2022.

The stock of domestic debt increased slightly by 1.7 percent, from D38.1 billion in 2022 to 38.8 billion in April 2023. This represents a decline in the debt-to-GDP ratio from 31.5 percent in 2022 to 27.6 percent in April 2023. In the year to endApril 2023, Treasury bills and Sukuk Al Salaam bills increased by 4.8 percent to D19.2 billion and accounted for 49.5 percent of outstanding domestic debt stock,” he further disclosed.

According to him, yields on government securities have risen further following the five monetary policy rate hikes since the beginning of the monetary policy tightening cycle, adding that the weighted average interest rate on treasury bills increased from 4.8 percent in December 2022 to 11.9 percent in April 2023.