By: Nyima Sillah

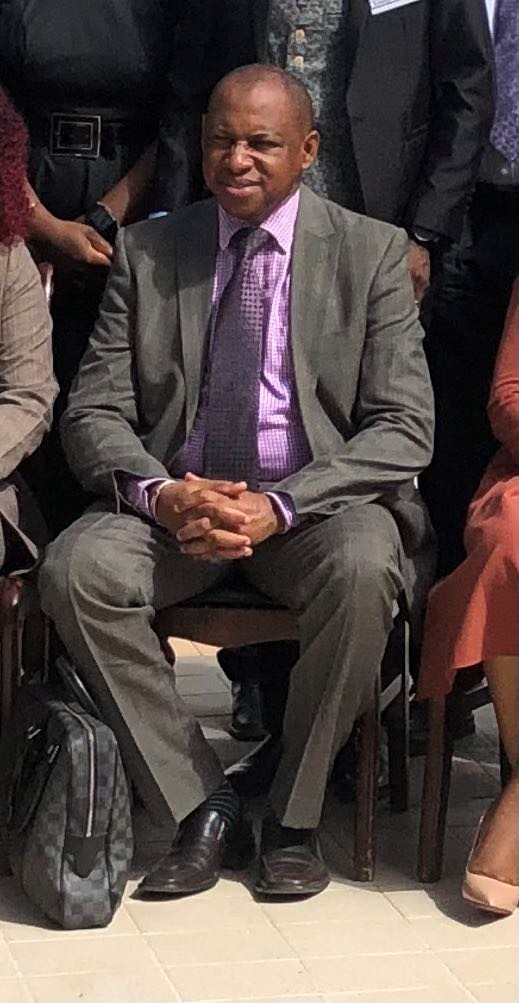

Saikou Touray, Director, Risk Management Department Central Bank of The Gambia has disclosed that the Gambian economy remains resilient, and it is gradually showing signs of recovery.

Speaking at the recent opening session of the IMF/WAIFEM regional course, Touray said from the domestic perspective, the Gambian economy remains resilient, gradually showing signs of recovery.

“This is supported by modest rebounds in tourism and private sector remittance inflows. Consequently, the economy is forecast to grow by 5.6 percent in 2023, which is higher than the 5.2 percent projected for 2022.”

The Central Bank, he said, through its Monetary Policy Committee (MPC) has implemented measures aimed at achieving a balance between the two main objectives of supporting growth but at the same time mindful of inflationary pressures.

“The future is gradually looking brighter, we remain cautious, aware of the uncertain geopolitical tensions and volatile commodity prices which could be exacerbated by prolonged war in Ukraine and continued supply constraints, with adverse effects on the modest achievements registered so far.”

Touray further stated that the Gambian banking system remains resilient and well-capitalized, with a risk-weighted capital adequacy ratio of 24.8 percent, in December 2022, higher than the regulatory threshold by 14.8 percentage points.

“Another critical financial soundness indicator is the liquidity ratio, which stood at 63.7 percent in December 2022, well above the prescribed standard of 30 percent, adding asset quality also remains impressive, with the non-performing loans ratio registering modest improvements. The NPL ratio declined from 5.2 percent in December 2021, to 4.6 percent in December 2022,” he added.

Meanwhile, he highlighted some global macroeconomic developments with bearings on fiscal performance. Saying recession concerns are surfacing as Russia’s invasion of Ukraine persists and the adverse effects of the COVID-19 pandemic linger.

He noted that global output contracted in the second quarter of 2022, owing to downturns in China and Russia, while US consumer spending undershot expectations (World Economic Outlook, 2022).

“In effect, fiscal policy trade-offs are increasingly becoming difficult, especially for high-debt countries where responses to the COVID-19 pandemic exhausted their fiscal space,” he said.

According to IMF’s Fiscal Monitor Report (2022), fiscal deficits fell sharply in advanced and emerging market economies in 2021 and 2022 but remain larger than pre-pandemic levels across income groups. The contraction in the average deficit for advanced economies and emerging market economies (excluding China) is notable, reflecting the unwinding of pandemic-related measures coupled with rising inflation (IMF’s Fiscal Monitor Report, 2022).