Governor of the Central Bank of The Gambia has stated that Gambian economy continues to recover from the pandemic-induced slowdown in 2020 and the medium-term outlook is favorable.

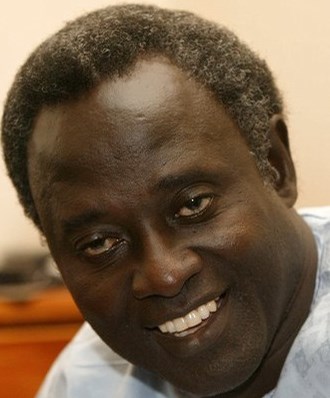

Governor Buah Saidy informed commercial bank managers and journalists recently at the Monetary Policy Committee (MPC) during the briefing of the data released by the Gambia Bureau of Statistics (GBoS).

“Growth was supported by pickup in fishing and aquaculture, construction, and a moderate recovery in services.

Notwithstanding the external shocks, the Bank’s leading indicators point to stronger economic activity in 2022. CBG staff forecast higher real GDP growth of 4.7 percent in 2022, premised on strong fiscal activities related to the ongoing public infrastructure projects, continued recovery in tourism and private construction,” he stated.

According to him, the downside risks to this outlook, however, are high and uncertain, including a protracted conflict in Ukraine, COVID-19 situation and the impact of weather conditions on agriculture.

He added that in addition, global economic uncertainties and lingering effects of the pandemic have somewhat 3 dented business confidences, as reflected in the Central Bank’s latest Business Sentiment Survey.

He indicated the adverse external shocks are putting pressure on The Gambia’s balance of payments, adding that recovery in tourism was slower than expected as external demand weakens and re-export trade yet to recover from the effect of the pandemic due to the adverse regional political developments.

He also said exports of goods and services grew by 13.2 percent (year-on-year) but remained below the pre-pandemic level.

He pointed out that more robust domestic demand and higher commodity prices have pushed up imports by 26.5 percent (year on-year). Income receipts and current transfers (net) also declined by 18.2 percent and 13.9 percent, respectively.

He added that a combination of these factors led to deterioration in the current account of the balance of payments from a deficit of 0.3 percent of GDP in the first quarter of 2021 to 2.3 percent of GDP in the first quarter of 2022.

Governor Saidy said that in the foreign exchange market, activity volumes remain robust, and the dalasi continues to be stable.

He added that the volume of transactions, which is an aggregate of sales and purchases of foreign currency, grew by 9.6 percent (year-on-year) in April 2022.

“Demand for foreign currency was driven mainly by energy and food imports, telecommunication and construction sectors, while supply continues to be supported by inflows from private remittances and slight recovery in tourism receipts.

From April 2021 to April 2022, the dalasi depreciated against the US dollar by 4.6 percent but appreciated against the euro and pound sterling by 3.9 percent and 1.8 percent, respectively,” he disclosed.

He added: “Annual broad money growth decelerated by 21.0 percent in March 2022 from 25.7 percent in the corresponding period last year, reflecting a slowdown in the growth of the net foreign assets (NFA) of the banking system.

Similarly, annual growth in reserve money, the Bank’s operating target, declined markedly to 14 percent from a growth of 32.4 percent over the same period. Reserve money was above the target for the March quarter by 2.1 billion, reflecting the rise in the net domestic assets (NDA) of the Central Bank.”

He disclosed that private sector credit expanded by 10.9 percent in March 2022 compared to 8.4 percent a year ago, adding that strong credit growth was mainly aided by significant growth in construction, distributive trade, fishing, energy and financial institutions sectors.

He reiterated that the financial sector remains stable and resilient with robust liquidity and capital adequacy ratios, revealing that the risk-weighted capital adequacy ratio of banks stood at 25.5 percent, well above the minimum regulatory requirement of 10 percent.

“Liquidity ratio was 89.7 percent, also above the minimum regulatory requirement of 30 percent. All banks met the minimum capital and liquidity requirements.

Non-performing loans (NPLs) were 4.6 percent of gross loans in March 2022, compared to 7.7 percent in December 2021. Banks have continued to make adequate provisions for the NPLs,” he said.

He added: “Fiscal policy was expansionary during the review period. Preliminary data shows the government financing gap widened in the first quarter of 2022 compared to the same quarter in 2021.

This is mainly attributed to the decline in revenue collected from taxes on international trade, non-tax revenue and a shortfall in budget support during the review period.”

Meanwhile, he said although within target, expenditure increased and was higher than what was observed in the same period in 2021.

He noted that as a result, the fiscal 5 deficit widened to stand at 2.3 percent of GDP in the first quarter of 2022 against 1.0 percent of GDP in the same quarter in 2021.

“Domestic debt remained relatively stable at 37.2 percent of GDP in the first quarter of 2022. Short-term Treasury bills and Sukuk Al-Salam bills constituted 50 percent of total domestic debt stock, followed by the thirty-year bond at 24 percent, three-year bond at 19 percent, five-year bond at 6 percent while the seven-year bond accounted for only 1 percent of the total,” Governor Saidy disclosed.